It is not unusual for me to make offers in relation to claimants’ bills of costs that represents only a fraction of the amount claimed. However, from time to time the response I receive is not simply the inevitable one of displeasure but what appears to be a genuine reaction of incredulity. There appears to be total disbelief in relation to the figures I have put forward, particularly in relation to document time in high value claims. The claimant’s lawyer takes the view that no solicitor, however good, could possibly be expected to undertake the work in so little time.

The problem that many claimant lawyers have is that their experience of what is "normal", in terms of time taken to run a claim, is often limited to no more than how long it takes them, or possibly some of their colleagues in the same firm, to run similar cases. They have no idea how other firms handle such claims or how quickly. If they spend 100 hours on documents for a certain type of disease claim they assume that is normal and reasonable. The fact that the majority of other firms, for a similar claim, might take, for example, 50 hours is something totally outside their field of experience.

On the other hand, as a defendant costs practitioner, I see large numbers of bills of costs from firms throughout the country. In my capacity as a manager, I have seen literally thousands more claims for costs beyond those I have dealt with personally. It is staggering the difference in the size of a bill from an efficient firm compared to those from inefficient firms. Before some readers start complaining that they should not be criticised for dealing methodically and conscientiously with their clients’ claims and not cutting corners, my experience is that the best fee earners, in terms of the results they achieve for their clients, are very often exactly the same ones who produce the most modest bills. It is often those firms that are not real specialists (despite their claims to the contrary) who under-settle claims, take twice as long to achieve under-settlement, and then produce the highest bills. One of the obvious criticisms of the current legal costs system is that it not only rewards inefficiency but fails to properly reward the skilled lawyer.

I fear that there is a similar danger for costs judges. The bills that come before them are invariably the ones that are the most excessive. A paying party (or at least one with any sense) will not take to detailed assessment a bill that is broadly reasonable. Even where the bill is overstated by 10-25% it will usually be possible for the parties to agree a compromise. Therefore, the cases that come before costs judges are usually ones where the amounts claimed are more likely to be at least 25%+ over what a paying party knows to be reasonable compared to cases run by other firms. More often, the amount claimed is 35%+ over a reasonable figure. So what do most costs judges have to measure these claims against? Other excessive bills that have also been brought before them to be assessed. You can see the problem. Costs judges run the danger of coming to believe the excessive bills that come before them are typical. There should be some process whereby costs judges routinely have submitted to them the bills produced by the best claimant firms so that they have a yardstick of excellence against which to measure claims for costs.

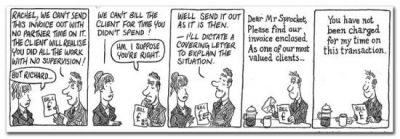

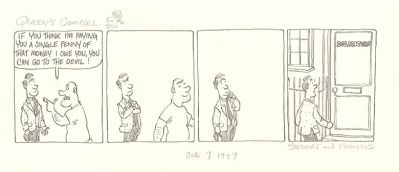

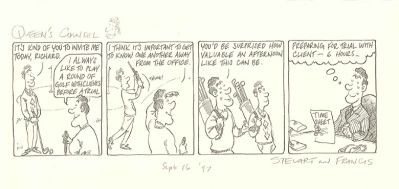

Click image to enlarge: