The heart of the problem concerning ATE premium levels was identified recently by Paul Ashurst writing in the New Law Journal: "one party buys insurance cover without handing over any cash and then hands the bill to the other party, who has no say in selecting either the cost or provider". The self-insuring deferred premium, which has become the norm, is central to this problem. Although this is a wonderful product from a claimant’s perspective, it removes any real market force from the system.

Lord Justice Jackson’s Preliminary Report on Civil Litigation Costs recognised this problem: "An issue which is sometimes raised is whether ATE premiums generally are unduly generous to insurers. In any given case, the insured demonstrates to the court the reasonableness of the premium paid by producing a statement as contemplated by the Court of Appeal in Rogers v Merthyr Tydfil CBC [2006] EWCA Civ 1134. That, however, is separate from the wider question of whether ATE premiums generally are too high or about right. In relation to this issue, insurers make the point that there are now 36 ATE providers (insurers and agents/intermediaries) active in the field. They contend that market forces bring premiums down to a proper level. This argument may have more force in relation to personal injury and clinical negligence litigation (where many insurers offer cover) than in relation to niche areas (where fewer insurers are competing for business). On the other hand, it has been suggested that the decision in Callery v Gray approving a figure as a reasonable premium in road traffic cases at the time has set that figure as a base-line and has resulted in the eradication of downward pressure in the market; and that the requirement for a Rogers v Merthyr Tydfil statement does not in practice ensure that premiums are competitive".

Later the Report observes: "In Callery v Gray (Nos 1 and 2) [2002] UKHL 28 Lord Hoffmann expressed the view that no market forces restrain the levels of ATE premiums. At paragraphs 43-44 he said this: ‘ATE insurers do not compete for claimants, still less do they compete on premiums charged. They compete for solicitors who will sell or recommend their product. And they compete by offering solicitors the most profitable arrangements to enable them to attract profitable work. There is only one restraining force on the premium charged and that is how much the costs judge will allow on an assessment against the liability insurer. Again, the costs judge has absolutely no criteria to enable him to decide whether any given premium is reasonable. On the contrary, the likelihood is that whatever costs judges are prepared to allow will constitute the benchmark around which ATE insurers will tacitly collude in fixing their premiums.’ Seven years have elapsed since Lord Hoffmann delivered that speech. There appears to have been a substantial growth in ATE insurance during that period. Whether or not market forces now exert any effective control over premium levels is very much a live issue, which I have touched upon in chapter 14 above. It is a fair point made by defendants that claimants have no interest in the level of ATE insurance premiums, because – win or lose – the claimants are never going to have to pay those premiums".

A recent edition of Litigation Funding reported Temple Legal Protection as recently providing ATE insurance for a case with a premium of £2.5 million with another case rumoured to have attracted an even larger premium. The sums at stake are significant.

The Rogers decision has been interpreted in many quarters as giving ATE insurers a blank cheque to set their premiums at whatever level they choose in the knowledge that the courts will not interfere with those premiums. Is that view correct?

Gibbs Wyatt Stone recently appeared for the Defendant in the case of Priest v CMT Engineering Insulation Ltd (17/3/09) in the Supreme Court Costs Office. The case concerned an asbestos related disease and an ATE policy with DAS 80e had been entered into by the Claimant with a three stage premium. The matter settled pre-trial and therefore only the first two elements of the staged premium were payable. These were calculated at £6,500. A third and final premium would have been payable 21 days pre-trial and that premium would have been individually calculated to reflect the risks of the case. Principal Costs Office Lambert agreed with the Defendant’s submissions that the first two premiums claimed were excessive. Using his own experience of other comparable ATE policies available on the market he reduced the amount to £2,750. The Claimant is appealing. It will be interesting whether the Court on appeal upholds the decision or decides, in effect, that an experienced costs officer or judge no longer has the power to interfere with an ATE premium following Rogers.

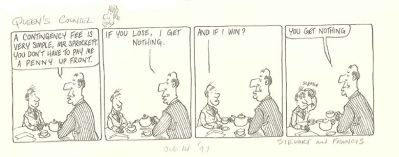

Click image to enlarge:

www.qccartoon.com