One of the more unfortunate costs provisions in the CPR is the general presumption that the receiving party is entitled to the costs of the detailed assessment proceedings. This encourages some receiving parties to submit inflated and unrealistic bills and, unless the paying party makes an offer that they consider puts them at real risk, pursue the matter to an assessment hearing without making any attempt at settlement or making any offers of their own.

It is worth mentioning at this point that an offer to settle a costs claim made under Part 47.19 does not carry any automatic consequence, unlike a Part 36 offer. The courts certainly do place enormous weight on Part 47.19 offers but it would be a mistake for either party to think that beating such an offer is determinative.

However, the approach of failing to actively engage in negotiations carries its its own dangers. CPR 47.18 lists the various factors that the court "must" have regard to when deciding whether to make an order other than that the receiving party recovers their costs. This includes the conduct of the parties and the amount by which the bill is reduced.

Referring to the case of Butcher v Wolfe [1999] 1 F.L.R. 334, the Court of Appeal in Codent Ltd v Dyson Ltd EWCA Civ 1835 stated:

"The second point to be derived from the case of Butcher is that there is an obligation to negotiate, placed upon the parties, which, as that case held, was not limited purely to family proceedings. A party who has refused a Calderbank offer point-blank and failed to negotiate might be penalised in costs if such refusal was unreasonable."

This approach has been reemphasised by Jackson J (now Jackson LJ) in Multiplex Constructions (UK) Ltd v Cleveland Bridge UK Ltd [2008] EWHC 2280 (TCC) where he held that if one party makes an offer to settle a claim which is nearly but not quite sufficient and the other party rejects that offer outright without any attempt to negotiate, then it might be appropriate to penalise the second party in costs.

In my experience, judges are willing to apply this reasoning to detailed assessment costs. Further, even where (rarely) I have not succeeded on my own Part 47.19 offer, I have often been able to persuade a judge to make a costs order in the paying party’s favour or no order for costs where the bill has been significantly reduced.

As readers are no doubt aware, Jackson LJ has now been given the task of undertaking a fundamental review of litigation funding. I am sure he is a regular reader of this blog and he may wish to consider the following modest proposal. Receiving parties have an enormous advantage in detailed assessment proceedings because they have access to something the paying party does not: their own file of papers. A receiving party is in a far better position than the paying party to actually calculate what their bill is really worth. Paying parties must always engage in a certain amount of guess work, however "educated" that guess is.

Why not introduce a rule that the receiving party must make an offer to settle in relation to their own bill of costs and they will not be able to recover their assessment costs if they fail to beat that offer? Something similar was proposed, but dropped, in respect of quantum hearings for the new claims process. This offer should be made at the same time as serving the bill and any further offers would provide no further protection. This would force receiving parties to sensibly value their costs from the outset and would almost certainly dramatically reduce the number of detailed assessment hearing.

I would be interested to hear readers’ views.

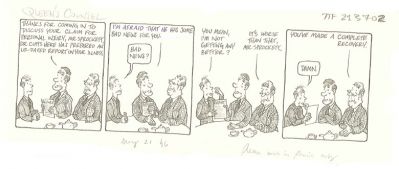

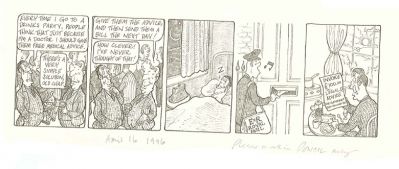

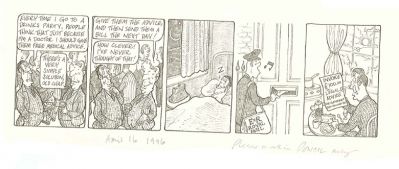

Click image to enlarge:

www.qccartoon.com